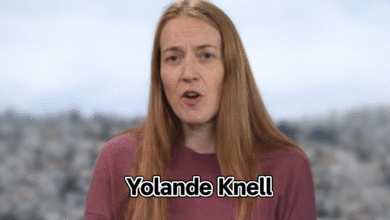

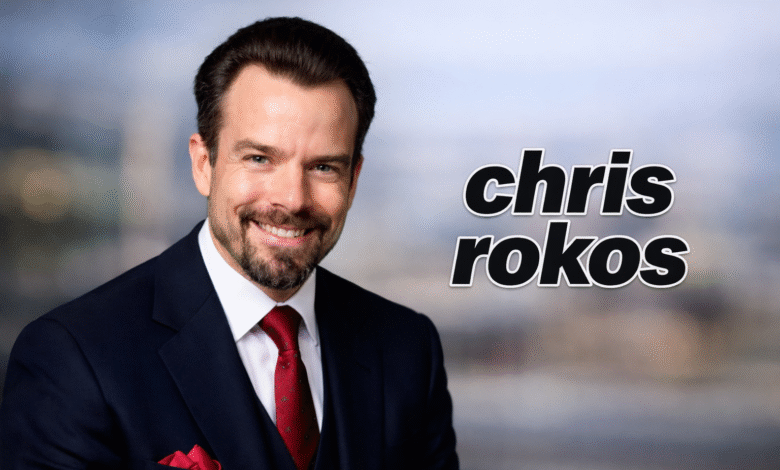

chris rokos: The Powerful Rise of a Global Macro Visionary

Table of Contents

ToggleIntroduction

Chris Rokos is widely regarded as one of the most formidable figures in global macro investing. Known for his analytical intensity, low public profile, and exceptional risk discipline, he has shaped modern hedge fund trading at the highest level. His journey from academic excellence to founding one of the world’s most closely watched macro hedge funds reflects both brilliance and relentless focus.

At the same time, Chris Rokos is not a universally celebrated public figure. His career includes controversy, legal disputes, and the immense pressure that comes with managing billions of dollars. This balance of achievement and challenge makes his story both inspiring and realistic, offering lessons for finance professionals and entrepreneurs alike.

Quick Bio

| Field | Details |

|---|---|

| Full Name | Christopher Charles Rokos |

| Known As | Chris Rokos |

| Date of Birth | 21 September 1970 |

| Age | 55 (as of 2026) |

| Birthplace | London, United Kingdom |

| Nationality | British |

| Profession | Hedge Fund Manager, Investor |

| Known For | Global Macro Trading |

| Company | Rokos Capital Management |

Who Is Chris Rokos?

Chris Rokos is a British hedge fund manager best known as the founder and Chief Investment Officer of Rokos Capital Management. He is also a co-founder of Brevan Howard, one of Europe’s most successful hedge funds. His name is closely associated with interest-rate trading and macroeconomic strategy.

Despite operating at the top of global finance, Chris Rokos maintains a highly private personal life. He avoids media exposure and public commentary, allowing his performance and results to define his reputation rather than public relations or self-promotion.

Early Life and Background

Chris Rokos was born in London and displayed strong academic ability from an early age, particularly in mathematics. His early education in the UK state system laid the foundation for a future defined by analytical thinking and structured problem-solving.

His intellectual promise earned him a scholarship to Eton College, a pivotal moment that placed him among some of the brightest young minds in the country. This environment refined his discipline, competitiveness, and appetite for excellence.

Education and Academic Foundation

At Eton College, Chris Rokos developed the rigorous thinking style that would later define his trading career. The school’s demanding academic culture reinforced his strengths in logic, precision, and independent thought.

He later studied Mathematics at Pembroke College, University of Oxford, graduating with first-class honours in 1992. His academic background is frequently cited as a key reason for his success in complex macroeconomic and derivatives-based trading strategies.

Start of Career in Finance

Chris Rokos began his professional journey in the financial markets shortly after graduating from Oxford. His early roles exposed him to the mechanics of global trading, risk management, and market structure.

He worked at UBS and later at Goldman Sachs, where he gained deep experience in derivatives structuring and proprietary trading. These roles sharpened his understanding of interest rates, swaps, and global financial flows.

Rise at Credit Suisse

In 1998, Chris Rokos joined Credit Suisse as a proprietary trader. This period marked a turning point, as he began to establish himself as an elite macro trader with a strong focus on government bonds and interest rates.

His performance and insight during this time attracted attention from senior figures in the hedge fund world, setting the stage for his next major career move and long-term influence.

Brevan Howard and Global Recognition

In the early 2000s, Chris Rokos co-founded Brevan Howard, a global macro hedge fund that rapidly gained industry recognition. The firm became known for disciplined risk control and consistent returns across changing market environments.

While at Brevan Howard, Chris Rokos was widely regarded as one of the firm’s most successful traders. However, the pressure and scale of the operation eventually led him to step away in 2012, choosing to retire temporarily and manage his own wealth.

Rokos Capital Management

After resolving contractual restrictions, Chris Rokos founded Rokos Capital Management in 2015. The firm was designed around a clear macro philosophy, strong central risk oversight, and selective talent recruitment.

Rokos Capital Management focuses on global macro strategies across interest rates, currencies, equities, and other asset classes. The firm’s performance has reinforced Chris Rokos’s status as one of the most influential macro investors of his generation.

Net Worth and Source of Income

Chris Rokos’s wealth primarily comes from hedge fund ownership, performance-based compensation, and long-term investment gains. His role as founder and chief decision-maker places him at the center of the firm’s financial success.

Public estimates of his net worth place him in the billionaire category, though exact figures vary by year and source. Like many hedge fund leaders, his earnings fluctuate with market performance rather than fixed salary structures.

Leadership Style and Investment Philosophy

Chris Rokos is known for his disciplined, data-driven approach to investing. He places strong emphasis on macroeconomic signals, risk asymmetry, and patience, avoiding unnecessary trades when conviction is low.

On the negative side, this high-control model can create intense internal pressure. Decision-making responsibility is concentrated at the top, which demands exceptional focus and emotional resilience over long periods.

Personal Life and Privacy

Chris Rokos keeps his personal life away from public discussion. Details about his family, relationships, religion, and lifestyle are not publicly disclosed, reflecting his commitment to privacy.

This discretion has helped him maintain focus but also limits public understanding of the person behind the investor. His legacy, therefore, is built almost entirely on professional impact rather than personal narrative.

Latest Developments

In recent years, Rokos Capital Management has remained a major player in global macro investing. Industry reporting highlights strong performance during volatile market conditions, reinforcing the firm’s relevance in a changing financial landscape.

Chris Rokos continues to influence macro-focused hedge fund strategy, even as competition intensifies and market dynamics evolve with technology and regulation.

Legacy and Long-Term Impact

Chris Rokos’s legacy lies in redefining disciplined global macro trading in Europe and beyond. From Brevan Howard to Rokos Capital Management, he has consistently emphasized structure, patience, and intellectual rigor.

While not without criticism or controversy, his career demonstrates how deep expertise and controlled risk-taking can produce long-term success at the highest levels of finance.

Conclusion

Chris Rokos represents both the power and pressure of elite investing. His career shows how analytical excellence can build immense value, while also highlighting the personal and professional costs of operating at the top of global markets.

Ultimately, his influence extends beyond returns. Chris Rokos has shaped how modern macro hedge funds think about risk, leadership, and longevity in an unpredictable world.

Frequently Asked Questions (FAQ)

Who is Chris Rokos?

Chris Rokos is a British hedge fund manager and the founder of Rokos Capital Management, known for global macro investing.

What is Chris Rokos known for?

He is best known for co-founding Brevan Howard and later establishing Rokos Capital Management.

Is Chris Rokos a billionaire?

Public estimates place him in the billionaire category, though exact figures vary by year.

What is Chris Rokos’s investment style?

His approach is global macro, focusing on interest rates, currencies, and macroeconomic trends.

Does Chris Rokos live a public life?

No, he is highly private and avoids media attention, focusing instead on investment performance.